Good products are not necessarily the most expensive. What you require are items that look great, are simple to keep, and last a very long time. Buy only from reliable dealers. If you plan to use the services of a dealership or professional, make sure to choose one with a reputation for honesty and excellent workmanship. There are several ways to inspect on a specialist: Before deciding on a professional, you might desire to get quotes from two or three various firms. Ensure that each bid is based on the same specs and the very same grade of products. If these quotes differ widely, discover why.

Under such a plan the contractor supplies all products utilized, takes care of all work involved, and arranges for your loan. Your specialist can make the loan application for you, but you are the one who must repay the loan, so you need to see that the work is done properly. The contract that both you and the specialist sign ought to state plainly the type and degree of improvements to be made and the products to be utilized. Before you sign, get the professional to define for you in specific terms: After the entire task Visit this page is finished in the way stated in your contract, you sign a conclusion certificate.

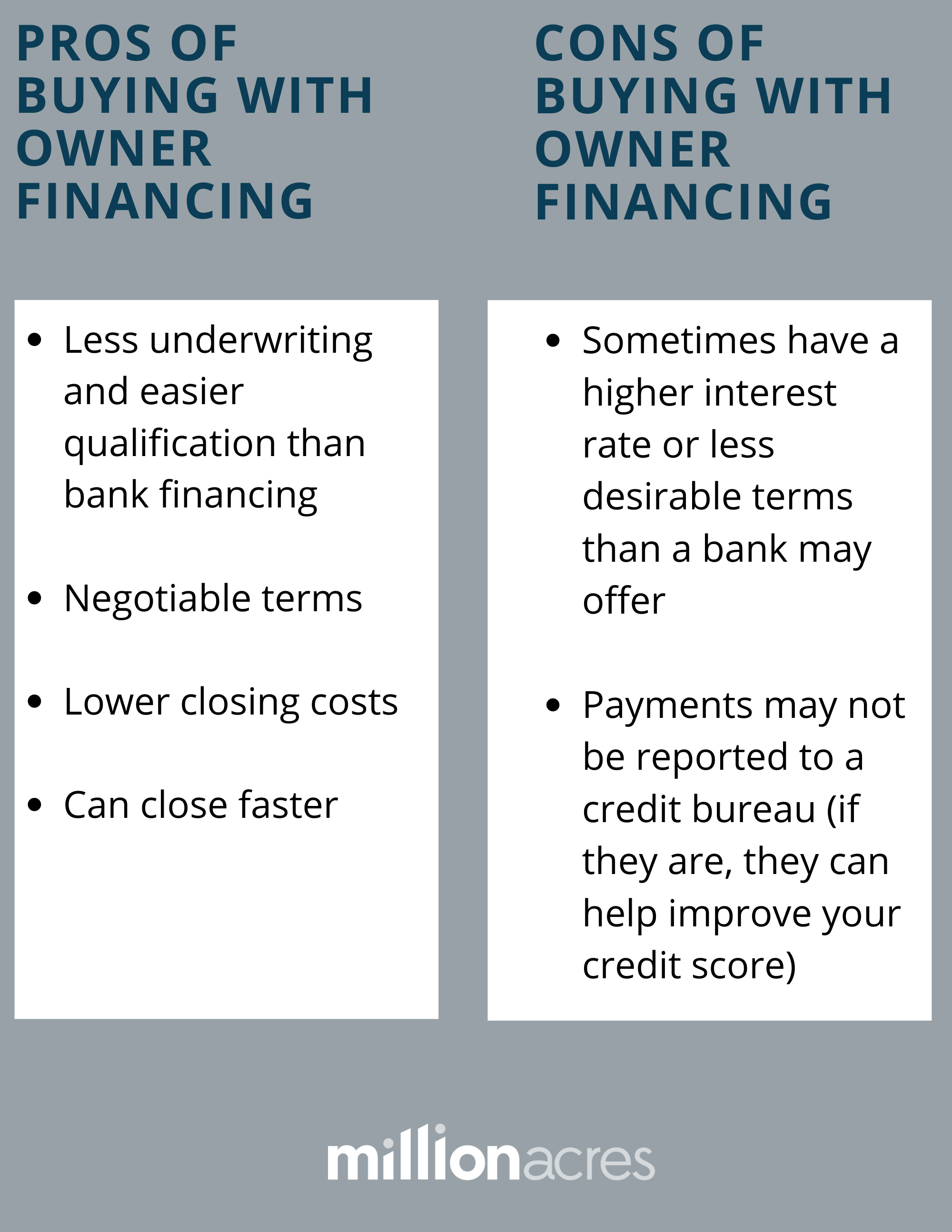

Most dealerships and specialists conscientiously attempt to provide their client services equivalent to the full worth of their cash. Unfortunately, home improvement rackets do exist. Here are a few typical sense rules to follow: As a guideline, the thriftiest method to finance improvements is to pay money. But if you do not have the funds even for immediate repair work such as changing a worn-out roofing system or a broken-down heating system, you ought to weigh the expense of borrowing against the expense of postponing the work. If you have to borrow, you wish to do it in the least pricey method. Use care when using charge card borrowing since of interest rates.

After examining to see if your credit is acceptable, the lending institution defines the terms of the loan and you should accept them before signing the note. Do not proceed with home improvement prepares up until you understand all of the costs involved. Today there are a variety of excellent prepare for funding house improvements on affordable terms - What is a note in finance. What sort of loan is best for you depends mostly on the quantity of money you need to obtain. If the equity in your home is restricted, the response might be an FHA Title I loan. Banks and other certified loan providers make these loans from their own funds, and FHA guarantees the lending institution against a possible loss.

FHA-insured Title I loans may be used for any improvements that will make your house basically more habitable and helpful. You can utilize them even for dishwashers, refrigerators, freezers, and ovens that are developed into the home and not free-standing. You can not use them for specific luxury-type products such as swimming pools or outside fireplaces, or to spend for work currently done. Title I loans can also be utilized to make improvements for ease of access to a handicapped individual such as redesigning kitchen areas and baths for wheelchair gain access to, lowering kitchen area cabinets, setting up broader doors and outside ramps, and so on. Another usage is energy saving improvements or solar energy systems.

Your loan can be utilized to pay for the contractor's materials and labor. If you do the work yourself, only the cost of products might be funded. HUD/FHA does not set the rate of interest. Rates of interest are worked out between the borrower and the lending institution. The optimum amount for a Single Household home enhancement loan for the modification, repair work or improvement of an existing single household structure is $25,000 and the optimum term is twenty years. The optimum quantity for a residential or commercial property improvement loan for the modification, repair work or enhancement of a Manufactured (Mobile) House that certifies as real estate is $25,090 and the optimum term is 15 years.

The maximum amount for a Multifamily Home Improvement loan for the alteration, repair, improvement or conversion of an existing structure utilized or to be utilized as a residence for two or more families is $60,000, however not more than $12,000 per dwelling system and the optimum term is twenty years. The maximum amount for a Nonresidential Residential or commercial property Enhancement loan for the building of a brand-new nonresidential structure, or the modification, repair, or enhancement of an existing nonresidential structure is $25,000 and the optimum term is 20 years. To discover an FHA-approved loan provider in your area, call HUD's Client service Center toll-free: (800) 767-7468 (TTY: (800) 877-8339) for a list of lenders in your state.

The Buzz on How To Become A Finance Manager At A Car Dealership

The Fair Housing Act restricts discrimination in housing and related deals-- consisting of home mortgages and house improvement loans. Lenders may not reject funds or deal less favorable conditions in loaning on the basis of the customer's race, color, religious beliefs, sex, national origin, familial status (i. e., the presence or number of kids in a home) or disability. In addition, lending decisions may not be based on the race, color, sex, religious beliefs, nationwide origin, familial status or specials needs of individuals associated with the debtor give back timeshare or with the location surrounding the home (The trend in campaign finance law over time has been toward which the following?). If you think you have actually been Great site the victim of discrimination in mortgage lending on among the restricted bases, you might submit a reasonable real estate problem by getting in touch with a local reasonable housing advocacy group, the Office of Person Rights for your state or city government, or by calling the national Fair Housing Hotline at (800) 669-9777 (TTY: (800) 927-9275.

Among the greatest advantages of homeownership is having the ability to change your house to better fit your present and future. Huge home improvements and room remodels are a number of ways, but for today, let's focus on the house addition. Executing a house addition is a great way to increase the worth of your home, in addition to making your living space larger and better to your present living situation. Naturally, funding a house addition is no low-cost endeavor. And depending upon the addition you're considering, it can get pretty costly when you consider costs for labor, products, and fees.

In it, we personify four popular house additions and let them tell you how the homeowners funded them, in addition to the stories behind each addition. For instance, here's a sneak peek of how a homeowner utilized a cash-out refi to finance the house addition. A cash-out refi is one of the most popular ways to money an addition on a house. If you're not familiar with how it works, you basically replace your current home loan with a new one that has a larger outstanding principal balance and most significantly, you get the difference as a lump sum of money. Find out more about the cash-out refinance procedure here.

However, a cash-out refi is just one example of how you can finance a home addition. To see what a brand-new restroom, sun parlor, and back deck have to state about how they became, click below.